It’s the time of year when a lot of changes happen. There are marriages, graduations and young adults who are college bound – or career bound. If the event falls outside the coverage walls of your auto insurance policy you could have an uninsured driver and these events could bring life to an abrupt stop for you and your family without you even realizing it. Let’s see if you have an uninsured driver.

There is a strong possibility one, or several, of these life situations might apply to you.

The following information is meant to be educational and may dispel common misconceptions about how insurance works. This message provides a basic overview of your auto insurance policy, including who is insured and at what level coverage applies.

The auto policy is a complex contract with many provisions, definitions, exclusions and coverage triggers; and most insurance contracts are different depending upon the insurance company.

Other Life Events Impacting Coverage

Here are a few more common events that can impact your auto insurance coverage (there could be other situations – so, simply call to discuss):

- A significant other or roommate moves in

- A family member moves out and takes your auto with them

- You purchase an auto and leave it up to the salesman to call us to provide coverage

- Your Family Member buys an auto in their name

- You transfer one of your autos to your Family Member

- Someone in your household is an Uber, Lyft or other type of driver.

- You or a listed driver has access to another vehicle (this is also referred to as regular use)

- You or one of your listed driver’s has a suspended license

All of these examples could restrict or exclude coverage. However, most people continue to pay their insurance premium giving no thought to how their insurance will be affected by life changes. Most also think they have coverage because they paid their insurance bill on time. Unfortunately, this isn’t always the case.

When a claim occurs, the insurance company gathers facts to determine if coverage applies. Most of the facts are secured through an accident report taken at the scene along with statements provided by everyone involved. You do not want to discover there is no coverage after the claim is made. Or even worse, to learn the denial of coverage could have been avoided by making changes to your policy.

Who Does Your Auto Policy Cover?

When you look at your auto policy, whose name is shown under the title “Named Insured”? Is it just your name or is your spouse and/or domestic partner’s name shown as well? The person(s) listed under “Named Insured” is the YOU – and YOU is the best! No, that’s not a typo.

From an insurance standpoint, being a YOU in the auto and homeowner’s policy is the best! Those names become YOU/YOUR and being a YOU gives all (every last) benefit the policy has to offer. Please keep in mind that if you’ve recently transferred your property to a legal trust, it’s important for the auto (and home insurance) to be changed to reflect the trust entity.

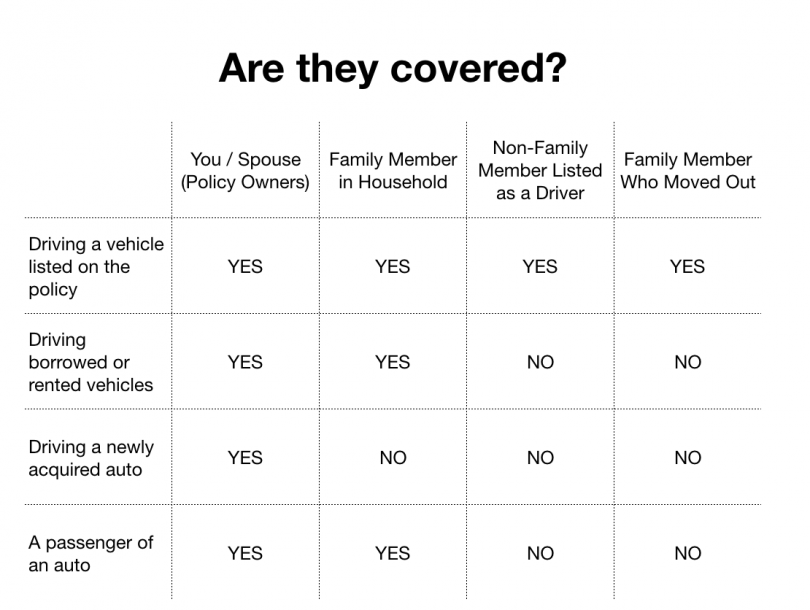

A Closer Look at the auto policy for uninsured drivers

Note on Driving newly acquired autos: If the vehicle is titled in YOU/YOUR name all can drive. But if titled in their name – NO coverage.

LEARN MORE HERE: Insurance is mandatory in Ohio Infographic on different types of coverage Why I can’t I insure a vehicle I don’t own?

SURVEY FORM BELOW: The survey form will help you determine if you have an uninsured driver.

Named Insured

The policy will provide the most coverage to those defined as YOU/YOUR barring a specific exclusion(s), limitations and within the coverage territory. As a “Named Insured,” you would be covered in these four key areas:

Key areas for coverage:

- Vehicles listed in the policy

- Vehicles borrowed or rented (as long as the borrowed vehicle isn’t available on a regular basis)

- Vehicles just purchased. (There is a limit of time the policy will extend when you purchase a new vehicle normally less than 14 days. Make sure you notify us when a vehicle is purchased – don’t pass this responsibility off to the salesman/dealership because if they don’t call us – you won’t have coverage if the accident happens after the allotted time.)

- Vehicles you occupy (passenger of an auto).

What happens to other drivers in your household? Will they be covered in all of these areas? Depending on their relationship to YOU, they have some benefits, but not all. Let’s look at who those people might be.

Family Member (must reside in your household)

There is a definition in the policy to describe “Family Member.” Basically, it states a person related to YOU by blood, marriage (and expands to include domestic partners in some policies), adoption; and possibly foster children, depending on their age – is considered a “Family Member.” Because each policy is different, it’s wise to review the definition in your policy. Coverage will trigger differently for YOU versus a “Family Member.”

Automatic coverage extends when YOU purchase a vehicle but not when anyone else in your household does. If a “Family Member” decides to purchase their own vehicle, they need to make insurance arrangements before they drive their newly-acquired auto because your policy will not transfer to them.

“Family Members” in the household would be covered in areas 1, 2 and 4 and if out-of-household only #1.

A parent can decide when their kid is out of the household and on their own, correct? Not really, and this is where the waters become murky. Think about these situations….

- Is it when they go away to school as a freshman?

- When they sign their first rental agreement (but are still in school)?

- When they graduate and decide to live where they made roots while in college?

- When they move in with their significant other (but are still receiving mail at your home)?

- When they go on to graduate school?

- When they test the job market out- of- town?

There is only one correct answer and it will likely be answered after the accident. Unfortunately, after the accident it’s too late to correct a possible gap in coverage. The parent will have no input to the facts taken at the scene of the accident or statements secured by the adjuster which is the facts that will determine if coverage applies and to what extent coverage applies.

If there is any possibility your adult child could be viewed as no longer living at home, don’t subject them to an uncovered claim, let’s have the conversation now. And, now that we’ve explained that the best coverage is extended to those listed as a YOU, there is no reason to wait – get them fully protected with their own policy! We represent several insurance carriers and will find the best for their situation.

Listed Drivers (Make sure these drivers aren’t uninsured drivers)

There are some instances where you may want to list a person (such as a nanny, caregiver or significant other) on your auto policy to disclose they may drive your auto.

Listing them gives the insurance company the chance to review their driving record to make sure they have an acceptable record. But it doesn’t give them full coverage under your policy.

Key area of coverage – only number 1 applies to a listed driver and even with that, the insurance carrier may require they make a claim to their own personal auto to pay all, or part, of the claim.

Vehicles ‘Furnished for Your Regular Use’

The policy excludes coverage when we drive an auto that is available for our regular use. It may be the car owned by our roommate (including college roommates), a neighbor, significant other, parent, or good friend. If you can grab the car keys easily without having to ask permission, chances are you have ‘regular use’ access.

Unfortunately, there is no clear-cut rule or definition of ‘furnished for your regular use.’

Just know that if you are driving an auto you don’t own you could be an uninsured driver, the insurance company will be looking into this to make sure the auto you were driving doesn’t fall into this category.

If it does, your policy will not pay for the injuries or property damage you’ve caused to the other party. (Repairs to the auto you were driving will come from the owner’s collision coverage).

If you or a family member has this situation, there is a way to close the gap with most insurance carriers and it isn’t expensive. It is worth a conversation if you think this limitation may apply to you or one of your family members.

Do you have uninsured drivers? Make an appointment today!

To schedule a phone review with Pat, copy this into your browser: http://www.selectinsservice.youcanbook.me

SURVEY FORM:

Select Insurance is providing this information to help you understand that as your life changes so should your insurance. The examples given are not the only life events that affect your insurance policy Every policy is different – consult your policy for the most accurate information.

12608 State Road, North Royalton, OH 44133 440|237-8555 www.selectinsservice.com

Copyright © – 2017 Summer